Credit Card Chip Technology and Security

From Computing and Software Wiki

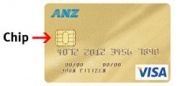

Credit Card Chip (Smart Card) is a technology where microchips are integrated into credit cards. These microchips are computerized chips with enhanced security features to prevent against identity theives and fradulments. Most of the major credit card issuers have been slowly migrating to the new technology because it could potentially save them millions of dollars every year.

Contents |

What is Credit Card Chip?

Chip and PIN Technology

The card being implemented with the technology will have a microchip integrated into it. According to a major credit card issuer, these chips are virtually impossible to duplicate.The purpose of this chip is to provide consumers with better seucurity measures.

How It Works

With the newly embedded chip, each card will then require to have a unique PIN number which is randomly generated by the credit card provider or it can be chosen by the customer him/herself. In addition, the credit card owner must remember this PIN for future transactions as it will replace any signatures required. However, for those merchants who do not want to migrate to the chip technology, traditional swiping and signature can still be used for day-to-day transactions.

Background

It all started in Europe with the technology being implemented into SIM cards for mobile phones. Later, Europe has utilized this technology in their credit cards during the 1990s to most of their countries. Seeing the dramatic improvement in securities, other countries are slowly adapting to the chip integrations.

Some of the countries who have their cards implemented:

- France

- England

- Australia

- Canada

However, not everyone agree with the technology. An example would be the United States where they are not embracing the chip.

Benefits

Credit Card Chip makes the current transaction system more secured. The Chip technology and PIN number are just an additional layer to the many layers of the current security system. For each transaction, the embedded chip generate a unique encrpyed transaction number to greatly reduce chance of fraud. Some of the many benefits include:

- Increased security against unauthorization (Stolen Cards)

- Decreases the chance of counterfeiting and skimming

- Protection against credit card fraud

- Speedier Transactions

Some Facts

- Over 73% of Canadians feel that the new system is more suitable for them and could greatly reduce fraud.

- The chip could potentially save Canadian $340 millions every year.

- PIN transactions are 40% faster.

Controversies

A main concern is the cost of implementation. For example, it costs millions of dollars to fully utilize the system in Canada. Does the benefits overcome the costs? In addition, some clients mentioned that they already have enough numbers and passwords to memorize, an extra will not be any better. Lastly, there would be no difference in terms of Debit Cards (Bank Cards) and Credit Cards once the chip is used.

- Benefits vs. Costs

- PIN vs. Signatures

- Credit Card vs. Debit Card

Terms

PIN - Personal Identification Number[1]

SIM - Subscriber Identity Module[2]

References

1. PIN (Personal Identification Number)

2. SIM (Subscriber Identity Module)

See Also

Smart Card technology to prevent fraud

External Links

Chip Cards

Introduce the Added Security of Chip and PIN

Benefits of Chip and PIN

Smart Card Wiki

New 'chip' credit cards stir security issues

Chip technology help foil credit card fradusters

Chip-based cards may cut into fraud

Matthew Au 01:16, 9 April 2009 (EDT)