Payment Card Industry Data Security Standard

From Computing and Software Wiki

The Payment Card Industry Data Security Standard (PCI DSS) is a security document created by the Payment Card Industry Security Standards Council (PCI SSC). To make the explanation of the PCI DSS a bit more interesting, I will be presenting it as an Industry Wide security do

Contents |

Security System Life Cycle

Threats

The main threat to the Payment Card Industry as a whole is more of a threat to the card holders than the industry itself. The card holders are taking a chance whenever they use their credit cards to make a purchase. This threat is not only present when purchasing online, but also when purchasing in stores. The threat originates from a lack of industry wide standards on how card holder information should be stored, processed or transmitted.

This security threat directly affects the Payment Card Industry because if cardholders don't trust that their information is secure, then they will not use their credit cards and hence the Payment Card Vendors loose business. This is why the Payment Card Industry is moving forward with their industry wide standard for security, the Payment Card Industry Data Security Standard.

Policy

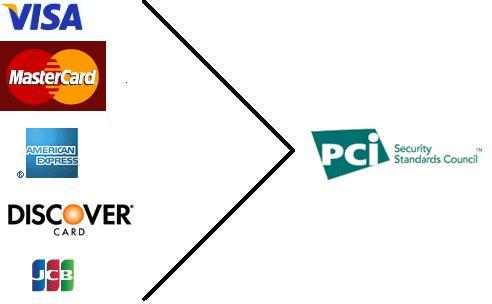

Before December 14th 2004, the 5 major Payment Card companies (Visa, Mastercard, American Express, Discover and JCB (Japan Credit Bureau)) each had their own set of Information Security Standards. This meant that retailers had 5 different security policies to comply to. After December 14th 2004, these 5 brands of cards collaborated to create the Payment Card Industry Security Standards Council (PCI SSC). The purpose of this council is to align the goals of each of the Payment Card companies an industry wide security policy for merchants to follow.

Security System Development

Requirements Specifications

There is a list of the full requirements here

Build and Maintain a Secure Network

1.)Install and maintain a firewall configuration to protect cardholders' data

2.)Do not use vendor-supplied defaults for system password and other security parameters

Protect Cardholder Data

3.)Protect stored cardholder data

4.)Encrypt transmission of cardholder data across open, public networks

Maintain a Vulnerability Management Program

5.)Use and regularly update anti-virus software

6.)Develop and maintain secure systems and applications

Implement Strong Access Control Measures

7.)Restrict access to cardholder data by business need-to-know

8.)Assign a unique ID to each person with computer access

9.)Restrict physical access to cardholder data

Regularly Monitor and Test Networks

10.) Track and monitor all access to network resources and cardholder data

11.) Regularly test security systems and processes

Maintain an Information Security Policy

12.) Maintain a policy that addresses information security

Template:Cite web

Design/Implementation

Operation and Maintenance

Summary

References

<references/>

See Also

Electronic Voting Systems

Social engineering

Piggybacking

Identity Theft

The Mitnick attack

Security and Storage Mediums

Operating Systems Security

Honeypot